What is Risk Management?

You may not realize it, but you plan your life and choices around risks every single day. When you are going through the pros and cons of a decision before you make it, this is essentially a risk assessment. You’re already practicing risk management in your life and didn’t even know it! But how do you turn these habits into an effective plan for your company?

In the business world,

risk management is defined as making plans and deciding moves that will have the least amount of impact on your organization in terms of risk. How risks affect your business can be objective in terms of insurance costs, but they can also be subjective too. If your reputation gets damaged or your business sees a decline in productivity, these are more difficult risks to manage, but it

can be done.

When you are practicing proper risk management, you are reducing the likelihood of risks in your business, which helps you protect yourself from profit loss and business failure. If you want to learn how to better manage your risk, then keep reading!

How is risk defined?

In any event where there is a likelihood of a profit or a loss, this is considered to be a risk. When we’re talking about loss, the risks in these instances are referred to as “exposures to loss,” or sometimes just “exposure.”

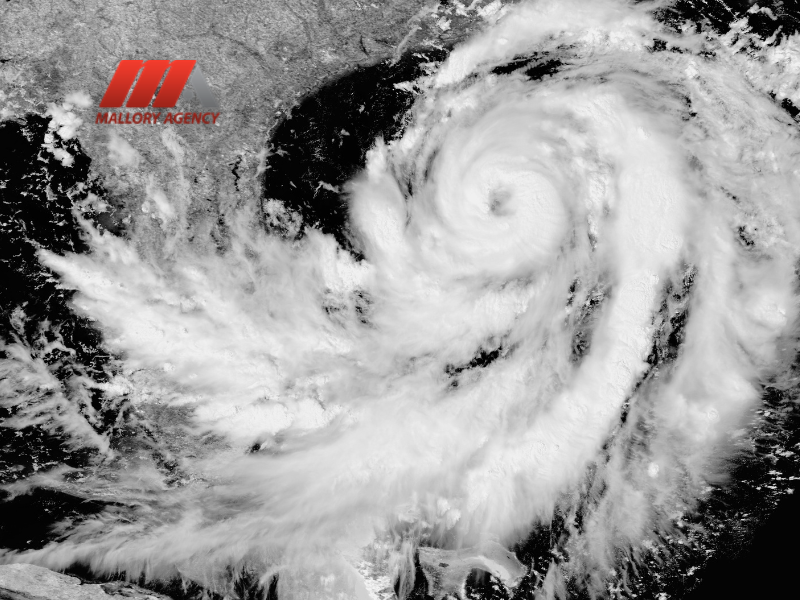

For example, a fire or other natural occurrence would be considered an exposure. If your business has defective items or angry customers slandering your name, these would be liability exposures. In terms of risk, any one of these exposures can lead to you losing your place of work or your entire business as a whole.

In the business world, risk comes in two main categories: pure and speculative. Pure risk includes things outside of your control, like a fire or burglary. In pure risk situations, the only outcomes are loss or no loss at all.

Speculative risk is a bit more complicated. This includes a wide range of outcomes, like loss, profit, or status quo. If you are investing in the stock market, expanding your business line, or opening up a new store, these are all considered to be speculative risks.

Why manage risk?

There are plenty of reasons why it’s a good idea to manage your risk. When you are effectively managing your risk, you can save and protect every aspect of your business. Your employees, your income, your properties and assets, your public image, your legal liability, and even the environment around you can all be preserved when you practice proper risk management.

The Risk Management Process, Simplified

The risk management process is a simple six-step procedure that will help your business avoid any major losses. We’ve outlined each step below:

- Pinpoint the exposures around you. Are there any current, real risks to your business? Do you see any natural disasters damaging your office in the immediate future, or are there any unhappy customers who may be trying to defame you?

- Assess the frequency and severity of these exposures. Run through the hypotheticals of each risk and see just how damaging each one could potentially be. Is there anything you can do to avoid these events, or even prepare for them?

- Explore alternate routes. The best way to face the unknown is to be as prepared as you can be. After you’ve become aware of every possible exposure to your business, you can combat these events by searching for alternative solutions to these problems.

- Narrow down your options. Research as many alternatives as you can, and then narrow down your choices to the most practical and effective moves.

- Implement your choices into your workflow. After you have chosen the best preventative measures for your situation, it’s time to remodel your business. Do what you can to make the implementation of these new procedures a smooth transition. No matter what has to change in your current business model, know that the growing pains will be worth it in the end.

- Track your findings. Keep an eye on how your business is benefitting from these changes. What’s working? What’s not? You can adjust your plans accordingly until you have an air-tight business model that allows you to be prepared for any kind of risk.

What is Risk Management in Insurance?

When you have an insurance company as your risk management provider, you are trusting a large group of people to use the money you give them to take care of you with these assets when you are in need. When you sign up for a variety of insurance plans, you are effectively preventing major losses in your company. No matter what situation comes your way, with the proper insurance plan, you won’t have to worry about going bankrupt.

An insurance agreement is an investment between you and your insurance provider. Your business is the insurance company’s profit, as you’re paying for their services. And, in turn, the insurance company is an investment for your business, as their services can come in handy when you are in crisis. But in the meantime you don’t really have to think about them beyond paying your bill.

When you first meet with your insurance provider, there are a few procedures that occur. You will need to determine the worth of your assets and what you want to protect. From there, an underwriter will double check your numbers and assist the insurance company in writing up estimates for claims and expenses on these items. All of these numbers add up to how much your premium will be.

Risk Management and Business Insurance

When you need business insurance to protect the more important risks of your business such as surety bonds, safety and loss control, claims advocacy, and workers comp, you can rely on a professional group of providers like Mallory Agency. We specialize in servicing small to midsize organizations with their business insurance needs. When you work with Mallory Agency, you are effectively managing the risks for your business.

Risk Management and Personal Insurance

You don’t have to own a business in order to benefit from the services of Mallory Agency. Our personal insurance plans include everything you need to protect what’s most important to you, like home, auto, life, and watercraft. No one can predict the future, but being prepared for anything will definitely help you sleep better at night. You can eliminate the loss from pure risk events with the right personal insurance plan, and Mallory Agency is here to help.

Find Top Risk Management and Broker Services at Mallory Agency

Choosing the right insurance and risk management procedures is difficult if you’re doing it all on your own. But with Mallory Agency, this process can be simple. Our experienced professionals monitor industry trends and the current market, and we use these findings to consult with you about how you can improve your risk management practices. We can help you plan for the unexpected, and be prepared for the worst case scenario. Contact Mallory Agency today to learn more: 706-884-3339.